Bitcoin, the pioneering cryptocurrency, has faced significant scaling challenges since its inception. Scaling Bitcoin is pivotal for accommodating a growing number of transactions and users. This article delves into the multifaceted initiatives aimed at scaling Bitcoin, exploring their intricacies, benefits, and potential drawbacks.

1. The Scaling Challenge

Bitcoin, by design, has a limited transaction capacity. Its block size is capped at 1 MB, and blocks are added approximately every 10 minutes. This limit leads to bottlenecks, particularly during periods of high transaction demand, resulting in increased transaction fees and slower confirmation times.

2. Early Attempts at Scaling

Early attempts at scaling Bitcoin focused on increasing the block size. In 2017, a segment of the community proposed Bitcoin Cash, a hard fork of Bitcoin, which increased the block size to 8 MB. However, this approach has been criticized for potentially centralizing the network, as larger blocks require more resources to process and store, possibly excluding smaller, individual nodes.

3. Segregated Witness (SegWit)

Segregated Witness (SegWit) is a significant protocol upgrade to the Bitcoin blockchain, introduced as a solution to several key issues, most notably scalability and transaction malleability. Its implementation marked a pivotal moment in the evolution of Bitcoin, having far-reaching implications for the network's efficiency and future development. To understand SegWit more comprehensively, let's delve deeper into its technical aspects, benefits, and broader impact on the Bitcoin ecosystem.

Technical Aspects of SegWit

Structure of SegWit Transactions:

In SegWit, transaction data is split into two segments: the original data structure and the extended 'witness' data, which contains the scripts and signatures.

The original portion retains compatibility with systems that have not upgraded to SegWit, while the witness data is interpreted only by nodes that have upgraded.

Block Weight and Size:

SegWit introduced the concept of 'block weight,' which is a blend of the size of the block with and without the signature data, capped at 4 million weight units. This effectively allows blocks to be larger than the nominal 1 MB size without a hard fork.

The actual size of a SegWit block depends on the mix of SegWit and non-SegWit transactions. In practice, blocks can exceed 1 MB, sometimes reaching up to 2-3 MB.

Upgrading to SegWit:

SegWit was implemented as a soft fork, meaning it's backward compatible. Non-upgraded nodes can still process transactions and blocks but without interpreting or validating the new witness data.

This approach minimized disruption in the network during the transition period.

Benefits of SegWit

Increased Transaction Capacity:

By segregating the witness data, SegWit effectively increases the amount of transaction data that can fit into a block, enhancing the throughput of the Bitcoin network.

This increase is not as straightforward as raising the block size limit but provides a more nuanced approach to scaling.

Resolution of Transaction Malleability:

Malleability :

Transaction malleability is a concept primarily associated with cryptocurrencies, like Bitcoin, and refers to the possibility of altering transaction details in a way that changes the transaction's identifier (ID) without invalidating the transaction itself. This issue was particularly prominent in Bitcoin before the implementation of Segregated Witness (SegWit). Let's break down what this means and its implications:

Basics of Transaction Malleability

Transaction ID (TxID):

In Bitcoin and similar cryptocurrencies, each transaction is identified by a unique ID, known as the transaction ID (TxID). This ID is derived from the digital signature and other components of the transaction.

The TxID is crucial for tracking and verifying transactions on the blockchain.

Modifying the Signature:

Prior to SegWit, it was possible in Bitcoin to alter the digital signature of a transaction slightly. This alteration did not affect the legitimacy of the transaction (i.e., the sender still sent the same amount to the same recipient), but it did change the transaction's hash, and thus its ID.

These changes could be made by anyone who had access to the transaction data, not just the parties involved in the transaction.

Implications of Malleability

Double Spend Confusion:

The primary concern with transaction malleability was its potential for creating confusion regarding double-spending. If a transaction's ID was changed after it was issued, it might appear as if the same coins were spent twice.

This confusion could disrupt the tracking of transactions and the proper functioning of the network, particularly for services relying on transaction IDs for verification.

Impact on Bitcoin Exchanges and Users:

Exchanges and wallets that relied on TxIDs for tracking deposits and withdrawals were vulnerable to malleability attacks. An attacker could claim that a transaction didn't go through (since the ID changed) and request another transaction.

This vulnerability was notably exploited in the infamous Mt. Gox incident, where the platform claimed significant losses due to malleability-related fraud.

Challenges for Layer-2 Solutions:

- Layer-2 scaling solutions like the Lightning Network, which rely on unconfirmed transactions, were particularly sensitive to transaction malleability. A change in the transaction ID could disrupt the opening, maintenance, and closing of payment channels.

Resolution with SegWit

- SegWit addressed the issue of transaction malleability in Bitcoin by removing the signature information (the malleable part) from the data used to compute the transaction hash. With SegWit, even if the signature data is altered, the transaction ID remains the same, thereby resolving the malleability problem.

Transaction malleability was a significant concern in the early years of Bitcoin, posing security and operational challenges. The implementation of solutions like SegWit effectively neutralized this issue, enhancing the overall robustness and reliability of the Bitcoin network. This resolution was crucial for the development of advanced features and second-layer protocols in the cryptocurrency ecosystem.

SegWit fixes the issue of transaction malleability by removing the signatures from the transaction data, making it impossible to alter transaction ids through signature manipulation.

This improvement enhances security and simplifies the design of smart contracts and second-layer protocols.

Enabling Layer-2 Solutions:

- By resolving transaction malleability, SegWit paves the way for reliable implementation of layer-2 solutions, such as the Lightning Network, which enables faster and cheaper off-chain transactions.

Lower Fees and Improved Efficiency:

With more transactions fitting in a block, the average transaction fee on the network tends to decrease.

SegWit transactions are also more data-efficient, allowing the network to handle higher transaction volumes more effectively.

Impact

Gradual Adoption:

The adoption of SegWit has been a gradual process. Its uptake depends on wallets, exchanges, and other services in the Bitcoin ecosystem updating their software to support SegWit transactions.

As adoption increases, the network experiences more of the benefits associated with SegWit.

Influence on the Bitcoin Ecosystem:

SegWit's influence extends beyond just transaction capacity. It has set a precedent for how significant upgrades can be implemented on the Bitcoin network without causing disruptions.

Its successful deployment showcased the effectiveness of the Bitcoin community's consensus-driven approach to protocol upgrades.

Segregated Witness represents a nuanced and multifaceted approach to addressing some of Bitcoin's core challenges. Its implementation not only provided immediate benefits in terms of scalability and security but also laid the groundwork for future innovations and enhancements in the network. The ongoing adoption and integration of SegWit continue to shape the trajectory of Bitcoin's development, underscoring its importance in the broader context of cryptocurrency evolution.

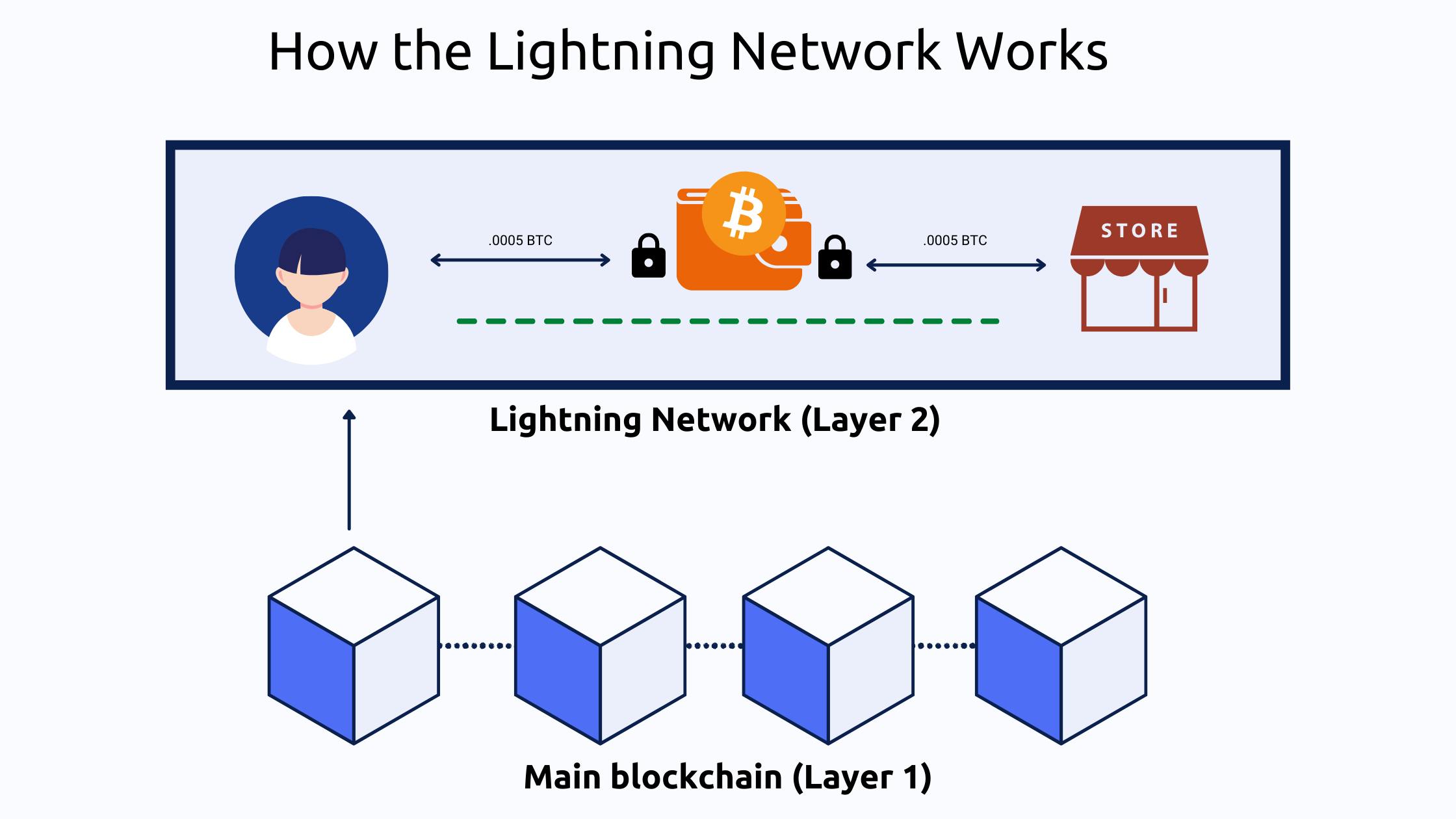

4. Lightning Network: A Second-Layer Solution

The Lightning Network represents a groundbreaking second-layer solution to Bitcoin's scalability and speed issues. It operates on top of the Bitcoin blockchain, offering a way to conduct numerous small transactions quickly and with minimal fees, without burdening the main blockchain. This technology is a pivotal development in the quest to make Bitcoin a more practical medium for everyday transactions, such as buying coffee or paying for services.

How the Lightning Network Works

Payment Channels:

The core concept of the Lightning Network is the creation of payment channels between two parties. These channels allow for virtually unlimited transactions between the parties.

The channel is established by creating a funding transaction on the Bitcoin blockchain, which locks a certain amount of Bitcoin.

Off-Chain Transactions:

Once a channel is open, the parties can transact with each other instantly and without fees. These transactions are off-chain, meaning they don't get recorded on the Bitcoin blockchain immediately.

The balances of both parties are updated with each transaction, but these updates are only known to the parties involved.

Settling the Channel:

The channel can remain open for as long as needed. When the parties decide to close the channel, the final balance is settled on the Bitcoin blockchain.

This final transaction reflects the net outcome of all transactions conducted off-chain.

Benefits of the Lightning Network

Scalability:

- By moving transactions off the main blockchain, the Lightning Network significantly reduces the burden on the Bitcoin network, enabling it to handle a much larger volume of transactions.

Speed:

- Transactions on the Lightning Network are almost instantaneous, which is a stark contrast to the time it can take for a transaction to be confirmed on the Bitcoin blockchain.

Low Fees:

- The Lightning Network offers extremely low transaction fees, making it feasible to conduct very small transactions, often referred to as micropayments.

Increased Privacy:

- Since transactions are not immediately recorded on the blockchain, the Lightning Network offers increased privacy compared to regular Bitcoin transactions.

Challenges and Considerations

Liquidity and Channel Capacity:

- For the Lightning Network to function smoothly, there needs to be sufficient liquidity. Channels need to have enough funds to cover the transactions going through them.

Routing Challenges:

- As the network grows, finding the most efficient path for a transaction to travel from sender to receiver becomes more complex.

Channel Opening and Closing Costs:

- While transactions within the network are cheap, opening and closing channels still requires on-chain transactions, which can be costly and slow, especially during times of network congestion.

Adoption:

- For the full benefits of the Lightning Network to be realized, widespread adoption is necessary. This includes user education and integration into wallets and services.

The Lightning Network is still in its relative infancy but is growing rapidly. It's seen as a critical part of the future of Bitcoin, particularly for small, everyday transactions. As the technology matures and more users and businesses adopt it, the Lightning Network could profoundly impact how Bitcoin is used, making it a more viable and versatile form of digital currency for a wide array of applications.

5. Sidechains

Sidechains are another approach to scaling Bitcoin. They are separate blockchains attached to the main Bitcoin blockchain, allowing for asset transfer between them. Sidechains can have different rules and features, potentially handling more transactions or supporting different types of applications. Liquid Network is a notable sidechain implementation, primarily targeting exchanges and financial institutions.

6. Schnorr Signatures

The introduction of Schnorr signatures is another significant development. This cryptographic technique allows for more efficient signature aggregation, reducing the amount of data per transaction. This improvement not only helps in scaling but also enhances privacy and security.

7. Challenges and Considerations

While scaling solutions are crucial, they come with trade-offs. For instance, off-chain solutions like the Lightning Network may lead to centralization concerns. Sidechains, while versatile, rely on their security measures, which might not be as robust as the main chain.

8. The Future of Bitcoin Scaling

The future of Bitcoin scaling is likely to be a combination of on-chain improvements and second-layer solutions. As the technology and adoption evolve, new ideas and improvements will emerge, each with the potential to further enhance Bitcoin's scalability.

Conclusion

Scaling Bitcoin is a complex, ongoing challenge that requires a delicate balance between maintaining security, decentralization, and increasing transaction capacity. The initiatives like SegWit, the Lightning Network, and sidechains represent significant strides in this direction. However, the journey towards a fully scalable Bitcoin is an evolving process, demanding continuous innovation and community consensus.